Binance: The New Norm of Investments and Trades

Welcome to Binance:

The new Norm of Investments and Trades

Binance is a platform for investments and trades using cryptocurrency. There are many advantages to this kind of platform, far way better than any other. Binance has the largest trading volume for trading.

Binance is a platform for investments and trades using cryptocurrency. There are many advantages to this kind of platform, far way better than any other. Binance has the largest trading volume for trading.

Binance have different types of wallet to consider.

- Fiat and Spot wallet - where you can exchange cryptocurrency to cryptocurrency without leveraging your position. Spot wallet is also the cryptocurrency wallet address for deposits.

- P2P wallet - This is the wallet where the transaction is for a deposited account made by person to person. It is safe to transact on Binance P2P.

- Margin wallet - It is for leveraging tokens that users can buy or sell with higher risk. Trade with certain precautions and good risk management.

- Futures wallet - Same on margin wallet thus the only base token will be USDT.

- Earn wallet - it is the overview of users low-risk investment.

Binance Earn Category:

In Binance Earn Category, users can choose any investments that have different interest rates, terms, yielding cryptos. They will enjoy the passive income of Binance and gains lesser activities on trading. Mostly on Binance Earn, the Token BNB and BUSD is frequently staked on different pools and staking pods. Know different earning capabilities of passive income on Binance Earn.

Binance Savings

On Binance Savings, there are two categories. One is the Flexible Savings where transferred tokens can be claimed instantly and freely. Its yielding interest is based on Token's progress in blockchain.

Another category is the Locked Savings where tokens that were transferred can be withdrawn depending on the chosen period from 7 days to 90 days. Its balances and interests will be sent automatically on your spot wallet.

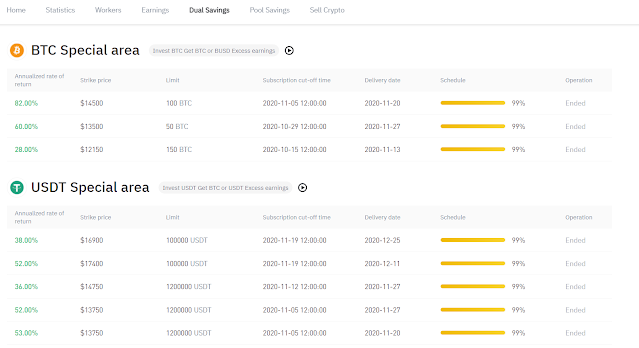

Dual Savings

It is a savings type where users can take interest base on the pair of cryptocurrency. If the user invests in BTC/BUSD, interest will be based on its market price. If BTC falls, the user will profit from BTC and if the BUSD trend is higher, the user will gain BUSD to profit.

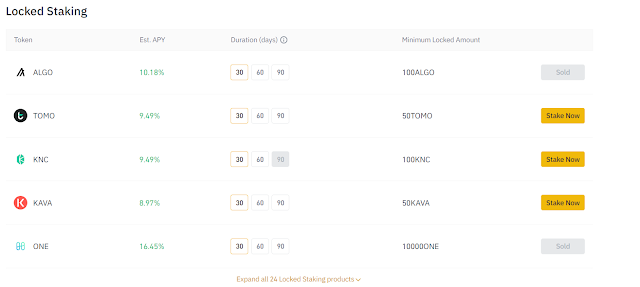

Locked Staking

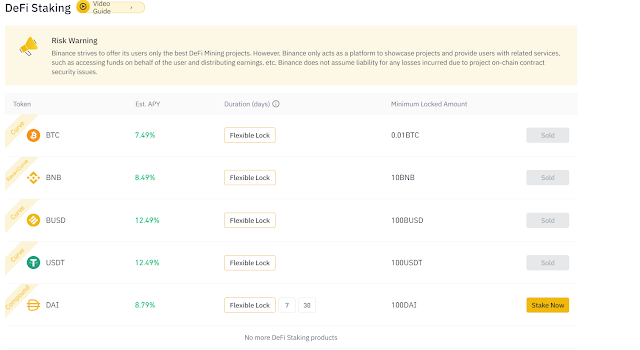

DeFi Staking

Short term for Decentralize Finance. A type of investment where smart contracts are used. Existing DeFi projects aim to provide higher annualized earnings for specific currencies.

Liquid Swap

Assets are pooled to form a liquidity pool where investors provide liquidity for cryptocurrency pair. Investors earn by the interest paid by traders of the pair cryptocurrency. This investment is perpetual. Click here for step by step: LP Token Staking

This type of investment is called Yield Farming where investors can earn different types of tokens. It is based on Binance SmartChain. Yield farming has different durations for withdrawing the funds plus the reward earned.

ETH 2.0 Staking

Since DeFi tokens use ETH's ERC network, ETH is now migrating its own chain for new proofing. From Proof-of-Work that uses hardware to mine ETH to Proof-of-Stake that are more secure, more private, less fees, and has faster transactions. Stakers of ETH 2.0 can now stake their ETH to Binance for higher yield but withdrawal of asset from ETH 2.0 is indefinite and can be last for two years. It is a long term investment that yields larger interest than any other DeFi products. Investing in ETH 2.0 will yield BETH or Beacon ETH. BETH will be 1:1 ratio with ETH Token. Click HERE for more info.